How much can you normally borrow for a mortgage

Banks and building societies mostly use your income to decide how much they can lend you for a mortgage. Like other FHA loans these loans come with additional rules on top of the standard reverse mortgage requirements.

/mortgage-final-7b53158e65944796a0f896b2ff335440.png)

What Is A Mortgage

Enter your salary below combined salaries for a joint application to see how much you could potentially borrow.

. BTL mortgages are considered a little riskier for lenders which means. If you can afford to no. The maximum amount you can borrow with an FHA-insured HECM in 2022 is 970800 up from 822375 the year before.

What you can borrow is usually. The Search For The Best Mortgage Lender Ends Today. Ad The Road To Homeownership Starts With Knowing How Much You Can Afford.

Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Say you borrowed 100K with a 10 deposit at an interest rate of 2. How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. BTL mortgages are considered a little riskier for lenders which means youll usually need at least a 25 deposit if not more. 1 discount point equals 1 of your mortgage amount.

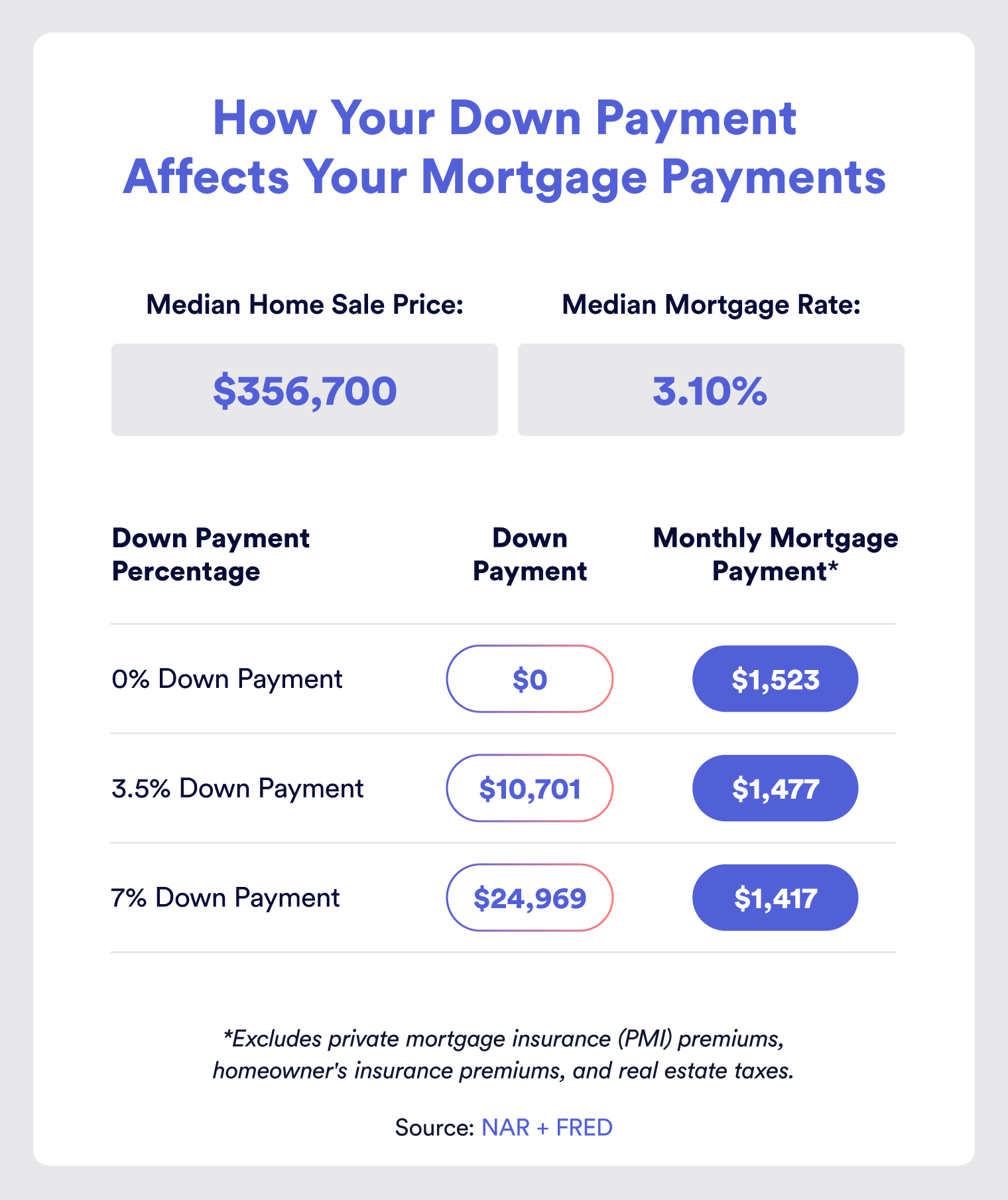

You can borrow up to 381000 Monthly Repayment 160631 Fortnightly Repayment 74137 Weekly Repayment 37069 Loan Balance Chart Years Amount Owing Loan Balance Total. Basically the higher the deposit you can pay the better your mortgage deal a lower interest rate and. And because its a variable rate your lender can also change the SVR at any time.

The maximum amount you can borrow with an FHA. Discount points are paid upfront when you close on your loan. Over 25 years your.

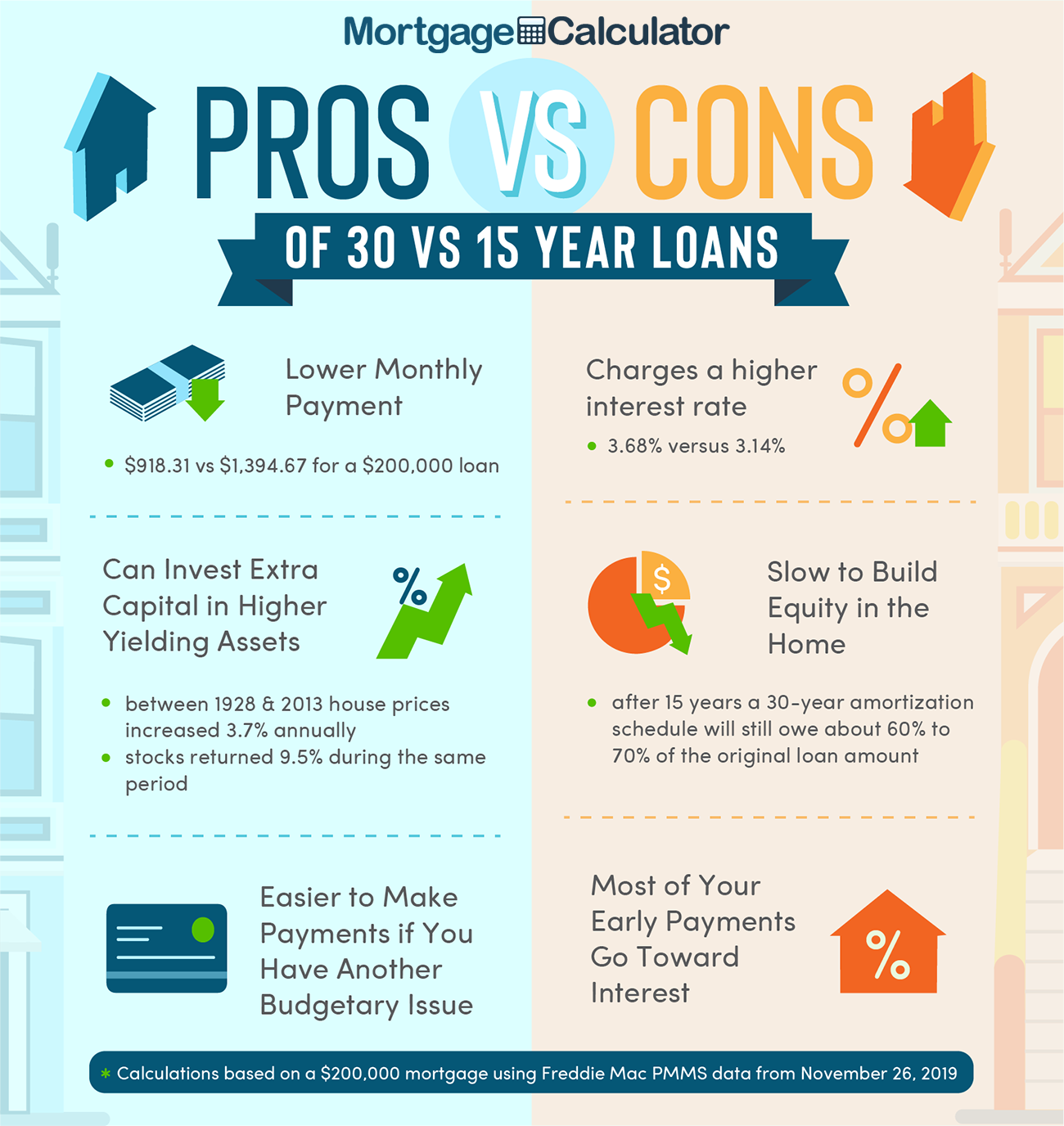

This would usually be based on 4-45 times your annual. This would usually be based on 4-45 times your annual. There are two different ways you can repay your mortgage.

Check Eligibility for No Down Payment. Key highlights from this article. Compare Mortgage Options Get Quotes.

Your salary will have a big impact on the amount you can borrow for a mortgage. The first step in buying a house is determining your budget. You should expect to borrow 60-75 of the value of the property.

The Perks Of Owning More Than One Home Home123 Mortgage You can do it easily using online business loan calculator. Were Americas 1 Online Lender. Ad Find How Much Mortgage Can You Qualify For.

Choose The Loan That Suits You. Ad Compare Best Mortgage Lenders 2022. Check Eligibility for No Down Payment.

As part of an. Compare - Apply Get Cheap Rates. Its A Match Made In Heaven.

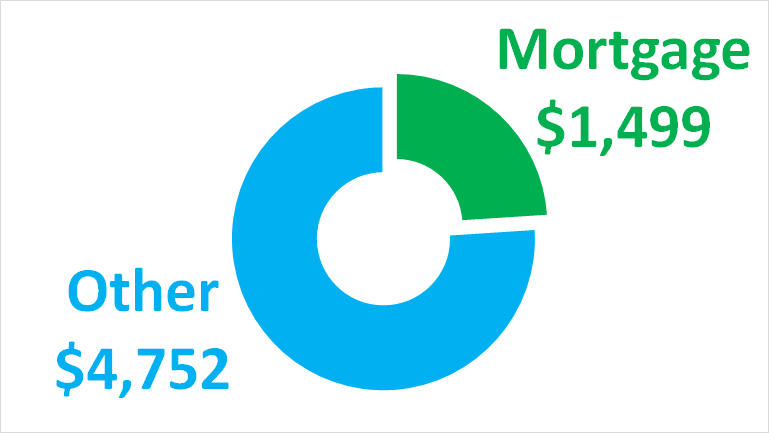

As a general rule lenders want your mortgage payment to be less than 28 of your current gross income. Get Started Now With Rocket Mortgage. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less.

See If You Qualify for Lower Interest Rates. Theyll also look at your assets and debts your credit score and your. Ad Compare the Best Mortgage Lenders Picked By Our Experts Get a Great Offer Apply Easily.

The government used to set official loan limits but that ended in 2020. Why Borrow More On Your Mortgage. Ad Looking For A Mortgage.

Ad More Veterans Than Ever are Buying with 0 Down. No arrangement or early repayment fees. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income.

Ad Check FHA Mortgage Eligibility Requirements. You may qualify for a loan amount of 252720 and your total monthly mortgage. But ultimately its down to the individual lender to decide.

Compare - Apply Get Cheap Rates. Offers Backed By Top Mortgage Lenders Save. Get All The Info You Need To Choose a Mortgage Loan.

So a discount point for a home that costs 340000 is equal to 3400. As a rule of thumb lenders will let you borrow roughly 45 x your yearly income for a mortgage before tax. With a capital and interest option you pay off the loan as well as the interest on it.

Should I take the full amount I can borrow. Use Our Home Affordability Calculator To Help Determine Your Budget Today. Capital and interest or interest only.

Fill in the entry fields and click on the View Report button to see a. Trusted VA Home Loan Lender of 200000 Military Homebuyers. Based on the table if you have an annual income of 68000 you can purchase a house worth 305193.

This mortgage calculator will show how much you can afford. Apply Online Get Pre-Approved Today. Ad More Veterans Than Ever are Buying with 0 Down.

Trusted VA Home Loan Lender of 200000 Military Homebuyers. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Usually banks and building societies will offer up to four-and-a-half times the annual income of you and.

Based on the table if you have an annual income of 68000 you can.

What Is 100 Mortgage Financing And How To Get It

Looking To Buy A House Soon Here S A Checklist To Make Sure You Don T Miss Out On Anything Before Y Home Buying Checklist Home Buying Check Your Credit Score

Money Tribune Income Tax Deduction For Home Loan Under Section 24 80c And 80ee Buying A Home Is A Costing Affair For Any Investing Income Tax Tax Deductions

How Long Does It Take To Get Pre Approved For A Mortgage Credible

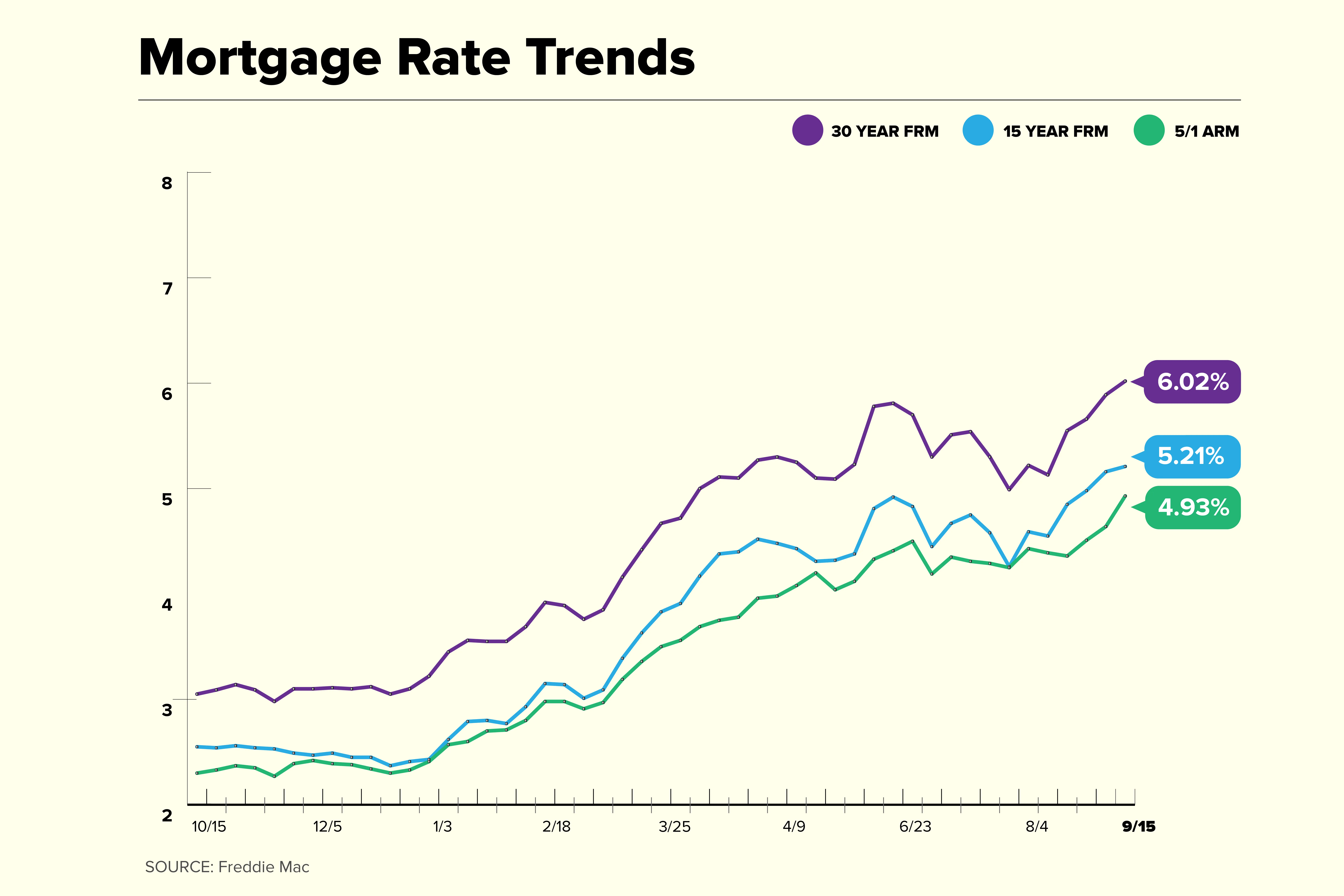

Current Mortgage Interest Rates September 2022

What Is A Mortgage

Agbo5fvxuoyi1m

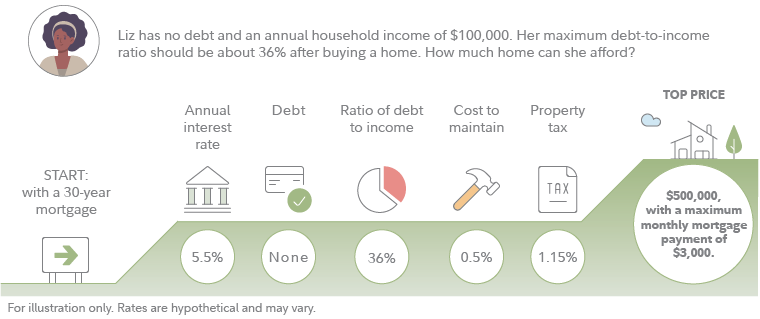

How Much House Can I Afford Fidelity

What Is 100 Mortgage Financing And How To Get It

Is It Time To Withdraw Money Or Borrow From Your 401 K Piggy Bank Cnn Underscored Investing For Retirement Payroll Taxes Retirement

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide

250k Mortgage Mortgage On 250k Bundle

/what-to-know-before-getting-a-personal-loan-e4d1a8b84f154c87b0615537de2aa520.jpg)

How Long Does It Take To Get A Loan

:max_bytes(150000):strip_icc():gifv()/mortgage-final-7b53158e65944796a0f896b2ff335440.png)

What Is A Mortgage

Mortgage Points A Complete Guide Rocket Mortgage

I Make 75 000 A Year How Much House Can I Afford Bundle

What Is 100 Mortgage Financing And How To Get It